If you’re a foreigner thinking to invest in Sri Lanka, you’ll definitely need to understand what is BOI approval in Sri Lanka. The Board of Investment of Sri Lanka, commonly referred to as the BOI, is the primary facilitator and regulatory authority for approving private Foreign Direct Investment (FDI) into the country. BOI approval is mandatory to register a company in Sri Lanka with more than 40% foreign shareholding, and to transfer more than 40% of shares in a non-BOI company to foreign investors.

Table of Contents

What is BOI approved in Sri Lanka?

BOI approved companies are known as ‘BOI Enterprises’. There are two main types of BOI approvals:

- BOI approval for section 16 projects

- BOI approval for section 17 projects

Projects approved under Section 16 of the BOI Law

Section 16 projects enables foreigners to have 100% ownership of a company incorporated in Sri Lanka in restricted economic sectors, provided they meet a minimum investment threshold of US$250,000. Section 16 only faciliatetes the entry of foreign investments. Therefore, companies registered under Section 16 operate under the country’s normal laws and do not receive any specific tax breaks or corporate tax concessions. For section 16 BOI companies outright land purchase is not allowed, but long-term lease rights of up to 99 years are permitted for foreign investors. BOI will issue visa recommendations for foreign investors, directors, senior management, expatriate employees (Technical & Skilled workers) and their dependents to qualify for residence visas.

However, sector-specific investment thresholds would still apply. For example, a pharmaceutical manufacturing company that’s 100% foreign-owned would only need a minimum investment of USD 250,000 to get Section 16 approval. However, if that very same company decides to expand into import and retail sales, the BOI would then require a minimum investment of USD 5 million.

Projects approved under under Sec.17 of the BOI Law

Section 17 projects begin at a minimum investment threshold of US$3 million and qualify for enhanced capital allowances under the Inland Revenue Act No. 24 of 2017 and exemptions from Customs Ordinance for custom duty-free imports. For larger investments exceeding US$50 million, BOI grants PAL and CESS exemptions during their project implementation period (PIP).

When do you need BOI approval in Sri Lanka?

To determine whether your foreign investment needs BOI approval, you’ll need to understand the exclusions and limitations on foreign ownership of company shares under the Foreign Exchange Act No. 12 of 2017. In particular, the Foreign Exchange (Classes of Capital Transactions Undertaken in Sri Lanka by a Person Resident Outside Sri Lanka) Regulations No. 2 of 2021published in the Gazette Extraordinary Notification No. 2213/35 dated 03 February 2021 specifically detail the investment thresholds and necessary prior approvals for foreigners buying and holding company shares in certain economic sectors.

Exclusions (Businesses where non-resident investment in voting shares is NOT permitted):

- Pawn brokering.

- Coastal fishing (as defined by the Minister of Fisheries).

- Retail trade where capital contributed by non-resident persons will be less than USD 5 Million.

“Retail trade” means the re- sale (sale without transformation) of new and used goods to the general public for

personal or household consumptions or utilisation.

Limitations (Businesses where non-resident investment in voting shares is restricted):

(1) Up to 40% (or higher with special BOI approval) of fully paid voting shares for:

- Production of goods where Sri Lanka’s exports are subject to internationally determined quota restrictions.

- Growing and primary processing of:

- Tea

- Rubber

- Coconut

- Cocoa

- Rice

- Sugar

- Spices

- Mining and primary processing of non-renewable national resources.

- Timber-based industries using local timber.

- Deep sea fishing

- Mass communication.

- Education.

- Freight forwarding.

- Travel agencies.

- Shipping agencies.

(2) Up to a percentage approved by the relevant legal or administrative authority for:

- Air transportation.

- Coastal shipping (as defined by the Minister of Shipping).

- Industrial undertakings specified in the Second Schedule to the Industrial Promotion Act, No. 46 of 1990, namely:

- Any industry manufacturing arms, ammunition, explosives, military vehicles and equipment, aircrafts, and other military hardware.

- Any industry manufacturing poisons, narcotics, alcohol, dangerous drugs, and toxic, hazardous, or carcinogenic materials.

- Any industry producing currency, coins, or security documents.

- Large scale mechanized mining of gems.

- Lotteries.

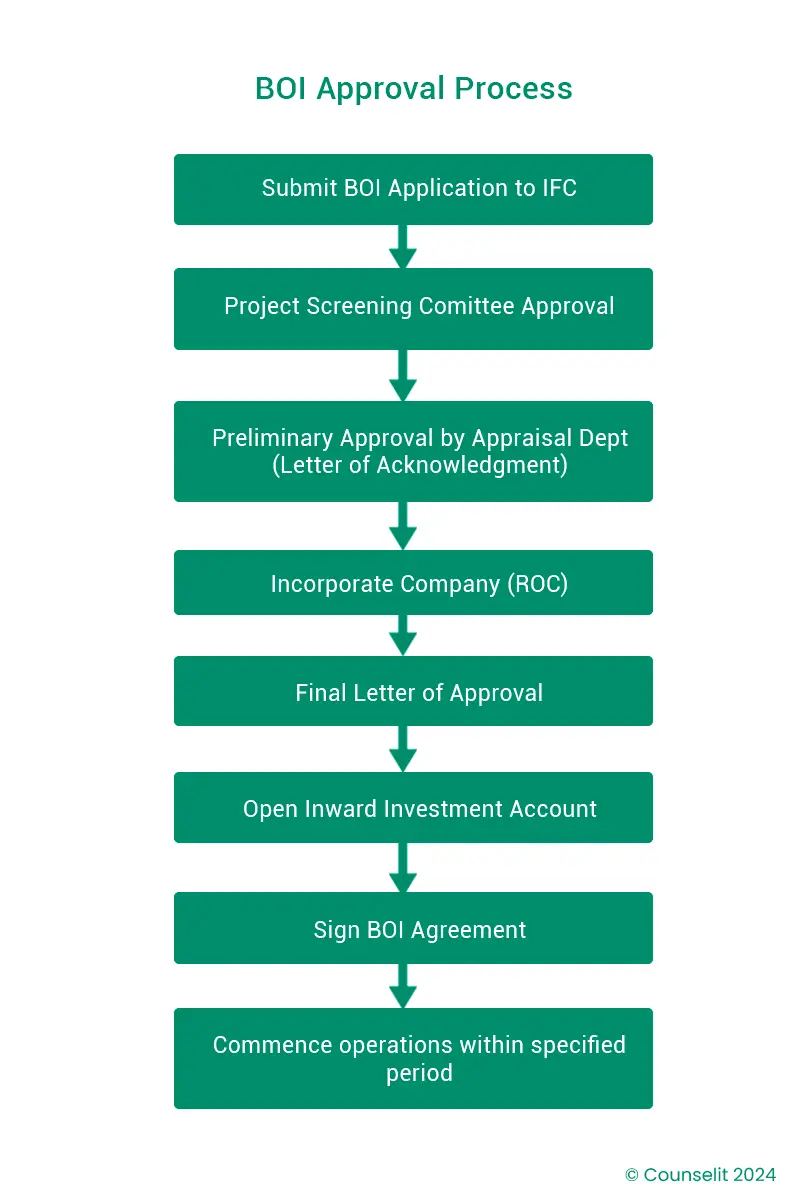

BOI approval in Sri Lanka step by step

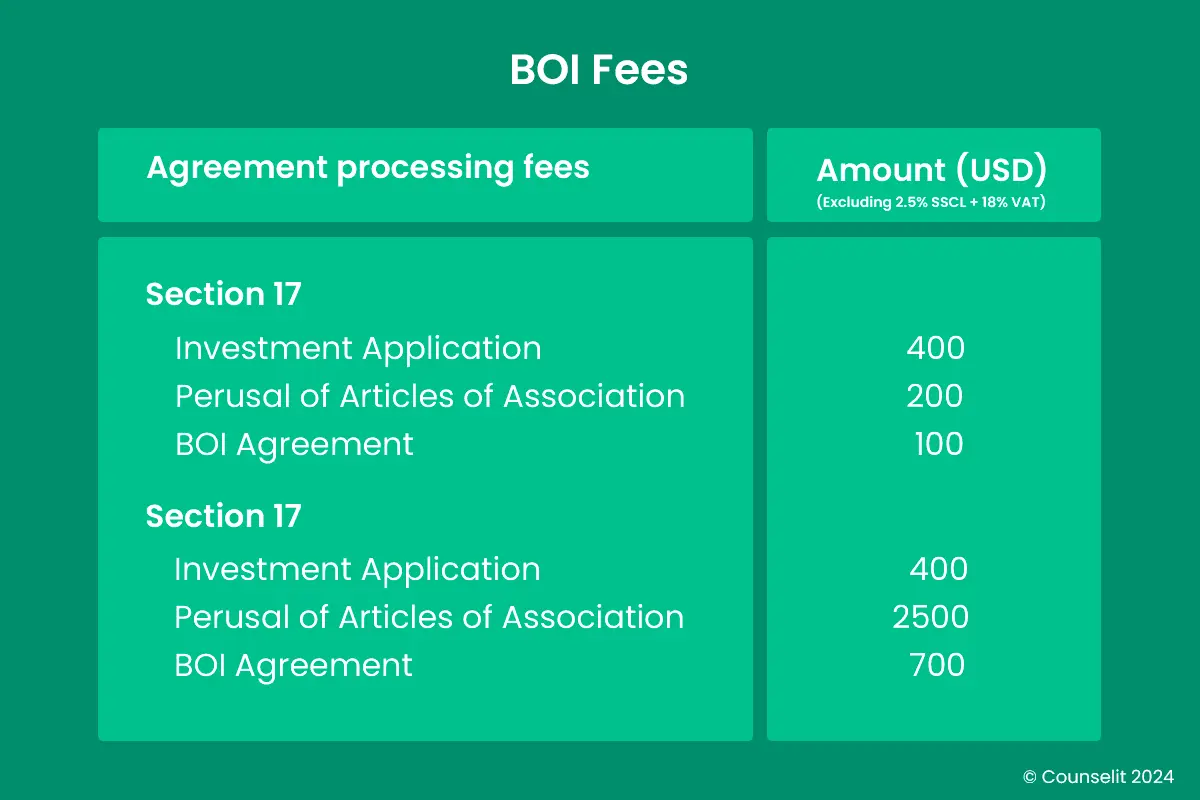

BOI Fees

Who can apply for a BOI approved project?

The foreign investor themselves or a local representative in Sri Lanka with a valid Letter of Authority from the investor can initiate the BOI application process. You can download the BOI application form from BOI the official website or collect from the Investor Facilitation Centre (IFC) of BOI is currently in operation at the 27th floor, West Tower of the World Trade

Centre (WTC). Once completed, pay the application fee of $ 400 + (2.5% SSCL) + VAT (18%) and submit the form along with all necessary supporting documents depending on the investment sector.

How to route funds to invest in Sri Lanka?

Foreign investors must route investment funds through an Inward Investment Account (IIA) opened in the investor’s name. IIA is a special type of account that eligible investors whether residing in Sri Lanka or overseas can use to channel funds into BOI approved investments. IIA accounts can be opened with a zero balance in the form of Savings Accounts, Fixed Deposit Accounts or Current Accounts at any Domestic Banking Unit of a Licensed Commercial Bank and Licensed Specialized Banks. The operation of IIA is governed by the terms set out in the Government Gazette No. 2045/56 dated November 17, 2017. Your IIA account can be maintained in Sri Lankan Rupees or in designated foreign currencies, and joint IIA accounts can be held by more than one eligible investor.

Here are the designated foreign currencies.

- United States Dollars (USD);

- Euro;

- Sterling Pound;

- Australian Dollars;

- Singapore Dollars;

- Swedish Kroner;

- Swiss Franc;

- Canadian Dollars;

- Hong Kong Dollars;

- Japanese Yen;

- Danish Kroner;

- Norwegian Kroner;

- Chinese Renminbi; and

- New Zealand Dollars.

How to register a BOI Company in Sri Lanka?

Every foreign-owned company in Sri Lanka must appoint a Registered Company Secretary (CS), as required by the Companies Act No. 7 of 2007. Your Company Secretary will assist you in preparing the draft articles of association. Once the draft articles are approved and the minimum investment has been successfully transferred into Sri Lanka via an Inward Investment Account (IIA), the BOI’s Project Screening Committee will grant preliminary approval and issue a letter of acknowledgment to the foreign investor. With the BOI-approved Articles of Association, your Company Secretary can then proceed with registering your company with the Registrar of Companies.

After your company is registered, your company will enter into an agreement with the BOI. Once this agreement is formalized, the BOI will issue its final approval, allowing your new BOI Enterprise to commence operations subject to the terms and conditions in the agreement.

What does it mean to be a BOI approved company?

Enhanced Capital Allowances (ECA)

Enhanced capital allowances are granted to BOI companies approved under section 17 in addition to the normal depreciation allowance.

| Investment Amount (USD) | Enhanced Capital Allowance (ECA) Rate | Period for Deducting Unrelieved Losses |

|---|---|---|

| > 3 million and ≤ 100 million | 200% | 10 years |

| > 100 million and ≤ 1,000 million | 200% | 10 years |

| > 1,000 million | 200% | 25 years |

During the period for which an Enhanced Capital Allowance (ECA) is granted, the employment income of a company’s expatriate employees can be subject to a 0% income tax rate. This beneficial income tax rate is available only when:

- the company has invested more than US$ 250 million in depreciable assets within Sri Lanka. This investment threshold needs to be met for the period in which the tax-exempt payment is made out of the profits sheltered by the ECA allowance, or for five years from the start of commercial operations, whichever of these two durations is longer.

- the total number of expatriate employees working for the company does not exceed twenty at any point during this period.

Customs duty / Port & Airport Levy (PAL) / CESS exemptions

BOI companies approved under Section 17 are eligible for tax exemptions on imports based on their export orientation and investment level.

Export-oriented companies with investments of USD 50 million or more are fully exempt from PAL, CESS, and Customs Duty on capital goods (plant, machinery, and equipment) for the lifetime of the project, and on construction items during the project implementation period (PIP). They are also exempt from duties on raw materials for the lifetime of the project.

All other export-oriented companies under Section 17 are exempt from Customs Duty on capital goods for the lifetime of the project, and on construction items during PIP. Raw materials are also exempt for the lifetime of the project, but PAL and CESS exemptions apply only if the investment exceeds USD 50 million.

Non-export-oriented companies with investments of USD 50 million or more receive exemptions from PAL, CESS, and Customs Duty on capital goods for the lifetime of the project, and on construction items during PIP. However, they are not eligible for any exemptions on raw materials.

Other non-export-oriented companies under Section 17 are only eligible for Customs Duty exemptions on capital goods (for the lifetime of the project) and construction items (during PIP). No exemptions apply to raw materials or under PAL and CESS.

Value Added Tax (VAT) exemptions and deferments

Export-oriented companies within Katunayake, Biyagama, Koggala, Kandy, Wathupitiwala, Malwatta, and Mirigama zones are fully VAT-exempt on capital goods and raw materials for the lifetime of the project.

Export-oriented companies outside these zones are VAT-deferred on capital goods and construction items during the project implementation period, and on raw materials for the lifetime of the project. Special exemptions also apply to garment and fabric manufacturers for raw material imports for the lifetime of the project.

Non-export-oriented companies, whether inside or outside the zones, receive VAT deferment on capital goods, plant, machinery, equipment, and construction items during the project implementation period.

Land ownership rights

Generally, outright purchase (freehold ownership) of land in Sri Lanka is restricted for:

- Foreign nationals

- Foreign companies

- Companies incorporated in Sri Lanka where 50% or more of the shares are held by a foreign national or a foreign company.

However, exceptionally large investments approved under section 17 is eligible for outright purchase rights under special terms. For section 16 projects, investors would need to acquire land on a lease basis.

How can I remit profits out of Sri Lanka?

Any returns on investments, such as sale proceeds, dividends, or profits, originating from funds channeled through an Inward Investment Account (IIA), can be remitted abroad via that same IIA account. However, before the money is remitted out of the IIA, banks often require a tax clearance certificate from the Inland Revenue Department to confirm all due taxes have been paid.

Dividends are currently subject to a 15% withholding tax, and the company as the withholding agent is responsible for remitting this tax before paying out dividends. Withholding tax on royalty payments is 14%. Similarly, if the company registered in Sri Lanka is a branch office of an overseas company, any outward remittances of profits to the parent company will be subject to a remittance tax of 14% (branch remittance tax).

Remittance tax can be avoided if you keep the total income within the country for a minimum of three years, starting from the first day of the assessment year immediately following the year the income was earned. This tax exemption is specifically granted when the retained income is reinvested in Sri Lanka. Eligible investments include expanding an existing business, acquiring shares or securities through the Colombo Stock Exchange (which is licensed by the Securities and Exchange Commission of Sri Lanka), or purchasing treasury bills, treasury bonds, or Sri Lanka International Sovereign Bonds issued on behalf of the Government of Sri Lanka.

Register your BOI Company in Sri Lanka with Counselit

Thinking about setting up a BOI company in Sri Lanka? Wondering what BOI approval is and whether you need it?

At Counselit, we’re a team of attorneys-at-law helping foreign individuals and companies make informed investment decisions in Sri Lanka. We guide you through the entire legal process of BOI company registration in Sri Lanka, making sure you understand what BOI approval in Sri Lanka means, and how it benefits your business.

Our Registered Company Secretaries will help you build a clear roadmap, choosing the right legal structure for your FDI, structuring your business activities to close the gap between minimum investment thresholds and your actual capital needs, and planning your taxes effectively, so you can avoid unnecessary capital lock-in and bring more profits back home.

Book a free 30-minute consultation or call us at +94 76 001 1066 to start your investment journey in Sri Lanka with confidence.