A common question we hear is how much does it cost annually to maintain a private limited company in Sri Lanka? When your sole proprietorship or partnership starts dealing with larger suppliers, signing more contracts, opening new branch offices, or exceeding tax thresholds, it’s worth considering a change in your business structure. For tax planning, asset protection, and risk management, many business owners opt to convert into a private limited company.

In this guide, we look at the post-incorporation costs that arise after registering a private limited company in Sri Lanka. These are the ongoing compliance and maintenance expenses, separate from the initial company registration fees.

To find out how much does it cost to register a company, check out our detailed guide on company registration fees in Sri Lanka.

Annual Compliance and Post-incorporation Costs for Private Limited Companies

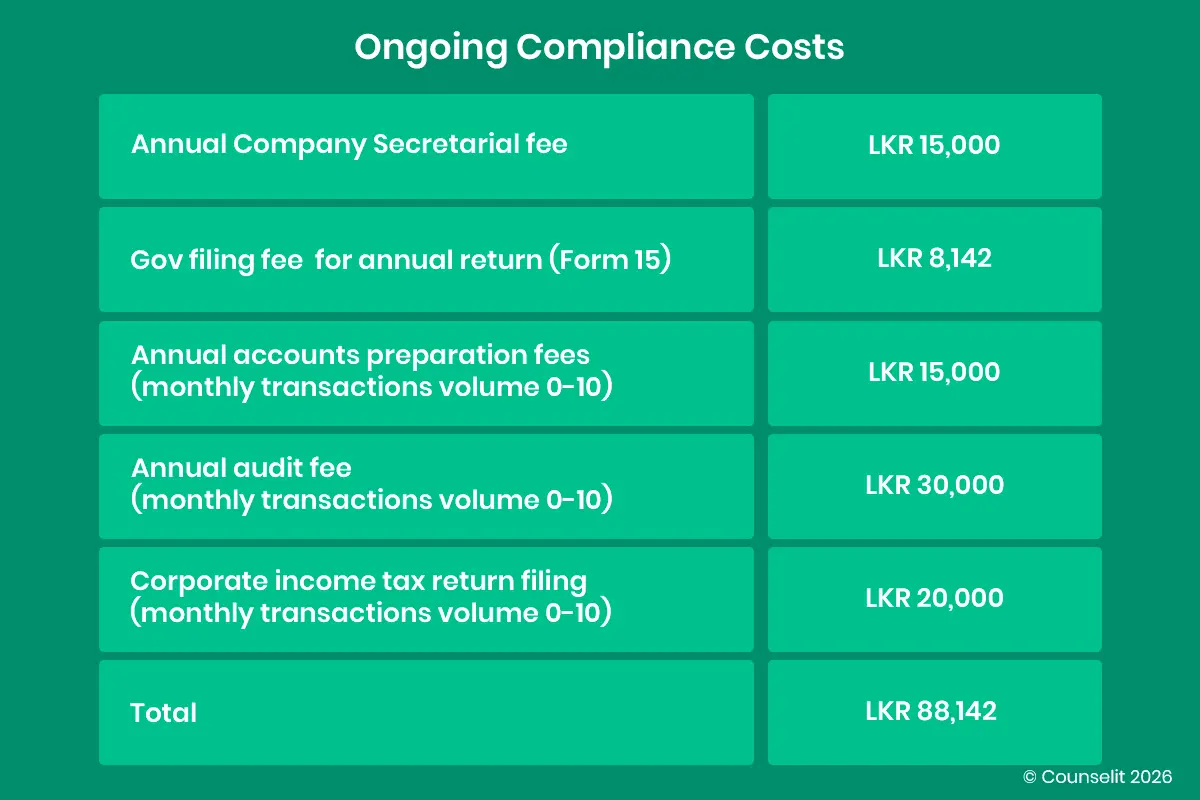

After you register a private limited company in Sri Lanka, there are five main ongoing costs that your company will incurr to stay compliant and avoid penalties or late filing fees.

- Annual company secretarial fee

- Annual return (Form 15) filing fees

- Annual final accounts preparation costs

- Annual audit fees

- Annual tax return filing fees

Annual company secretarial fee

For companies whose initial stated capital exceeds LKR 500,000, or whose annual revenue exceeds LKR 1 million, it is mandatory to retain the services of a registered company secretary to file eROC Form 19 – Notice of Consent of Secretary.

Some company secretaries include the retainer fee as part of their company registration package. Some charge the company secretarial retainer separately.

Once your company is registered, the annual company secretarial fee is payable yearly to the company secretary for acting as your company’s secretary. This fee can range from LKR 15,000 to 150,000 per year, depending on the industry, sector, and structure of your company.

Annual return (Form 15) filing fees

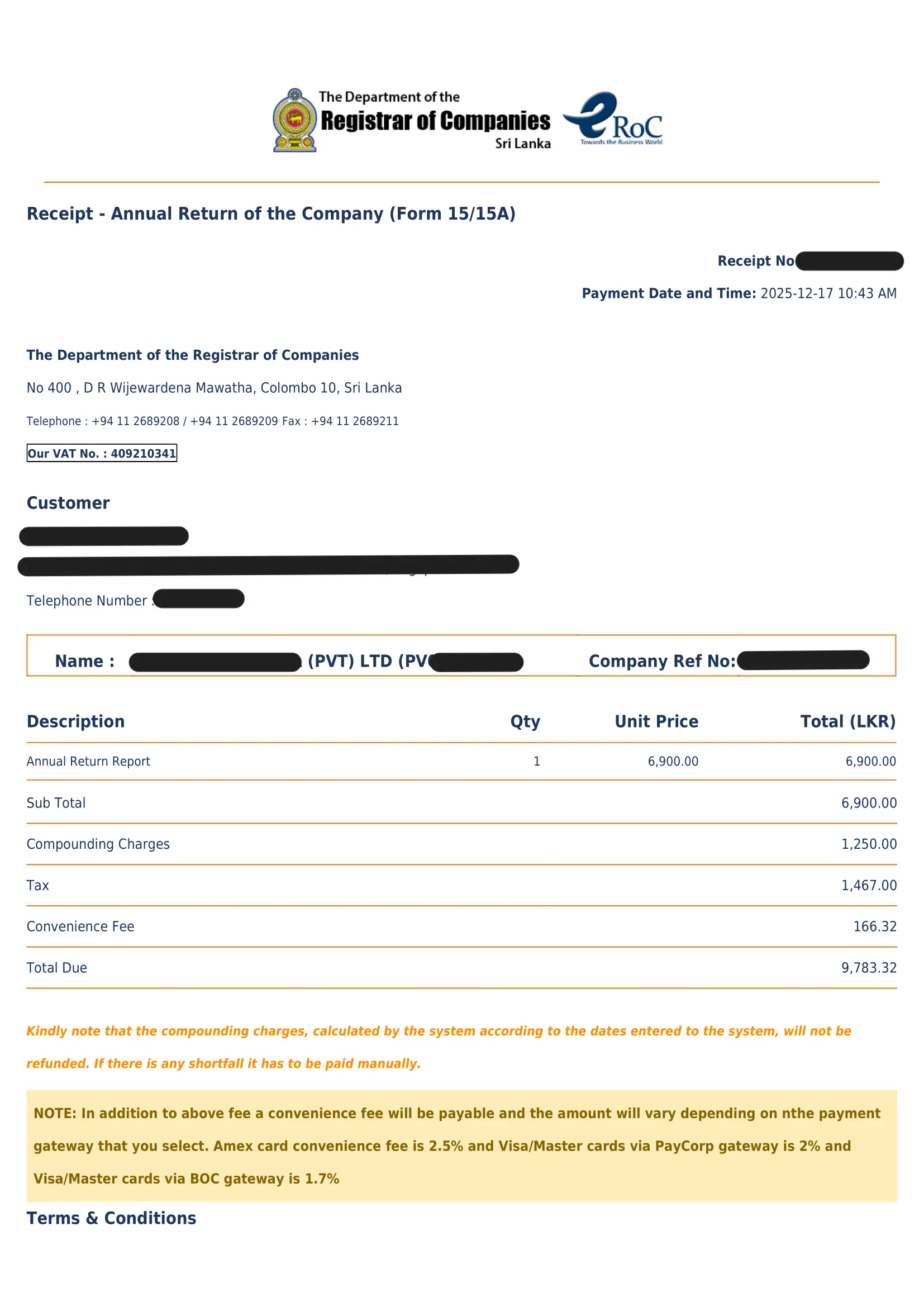

Every company must hold an Annual General Meeting(AGM) within 18 months from the date of incorporation and thereafter 12 months from the previous AGM and file the annual return (Form 15). The government cost for filing annual return is LKR 6,900 plus 18% VAT. When a company files its annual return late, the Registrar of Companies imposes a compounding charge as a penalty for non-compliance.

Your Registered Company Secretary will take care of preparing the AGM notices and minutes, or a resolution in lieu of an AGM, so the company’s annual return can be filed.

Annual final accounts preparation costs

Unless your company is a joint venture or an export/import business, there is no requirement to prepare accounts monthly or quarterly. However, all companies must prepare annual financial statements for each financial year (from 1st April to 31st March) to calculate the company’s tax liability and to prepare and submit the corporate income tax return.

The corporate income tax return must be submitted for each year of assessment. The year of assessment runs from 1st April to 31st March, during which the tax is calculated and paid by the taxpayer. The deadline for filing the tax return is on or before 30th November of the following year.

Therefore, it is essential to prepare the company’s final accounts for the previous financial year before 30th November of the succeeding year.

To prepare the company’s accounts, you can engage a Chartered Accountant. The cost of preparing annual financial statements typically ranges from LKR 15,000 (for companies with 0–10 monthly transactions) up to LKR 35,000 (for companies with up to 100 monthly transactions).

Annual audit fees

An audit report is a mandatory requirement when filing the tax return for a registered company. The audit report summarizes your company’s financial statements, internal controls, and accounting practices to determine whether the final accounts are accurate. Without an auditor’s report certified by a Chartered Accountant, the Inland Revenue Department will not accept the tax return as duly submitted.

To prepare the audit report, you will need to work with a Chartered Accountant (CA) registered as an auditor. Annual audit fees typically range from LKR 30,000 to LKR 45,000, depending on the company’s monthly transaction volume.

Annual tax return filing fees

Based on final accounts, your Chartered Accountant will compute the company’s tax liability and submit the corporate income tax return together with the audit report.

The cost of filing the corporate income tax return is approximately LKR 20,000, and the return must be filed on or before 30th November, which is within six months from the end of the financial year.

Contact Us Today For Corporate Compliance Guidance

At Counselit, we help companies stay on top of their corporate compliance obligations with ease and confidence. From ensuring your company meets annual regulatory requirements to developing clear processes and guidance for your team, we provide company secretarial, accounting, auditing, and tax filing support to keep your company fully compliant.

If you’re wondering how much it costs to maintain a private limited company in Sri Lanka, we can guide you through all the compliance requirements and associated fees.

Get in touch with us today to review your compliance needs and see how we can help keep your company in good standing. Call us on +94 760 011 066, or book a free initial consultation with Counselit.