To register a company in Sri Lanka, you will need a local address as company’s registered office address. Under section 113 of the Companies Act No. 7 of 2007, every company must have a registered office in Sri Lanka. Therefore, choosing the right registered office address is an important step in the company registration process.

What is a registered office address?

Registered office address is the the company’s legal address registered with the Registrar of Companies. It is the official mailing address where notices from the Inland Revenue Department, Customs, legal documents, correspondence from banks and other government institutions are delivered, and company records are kept.

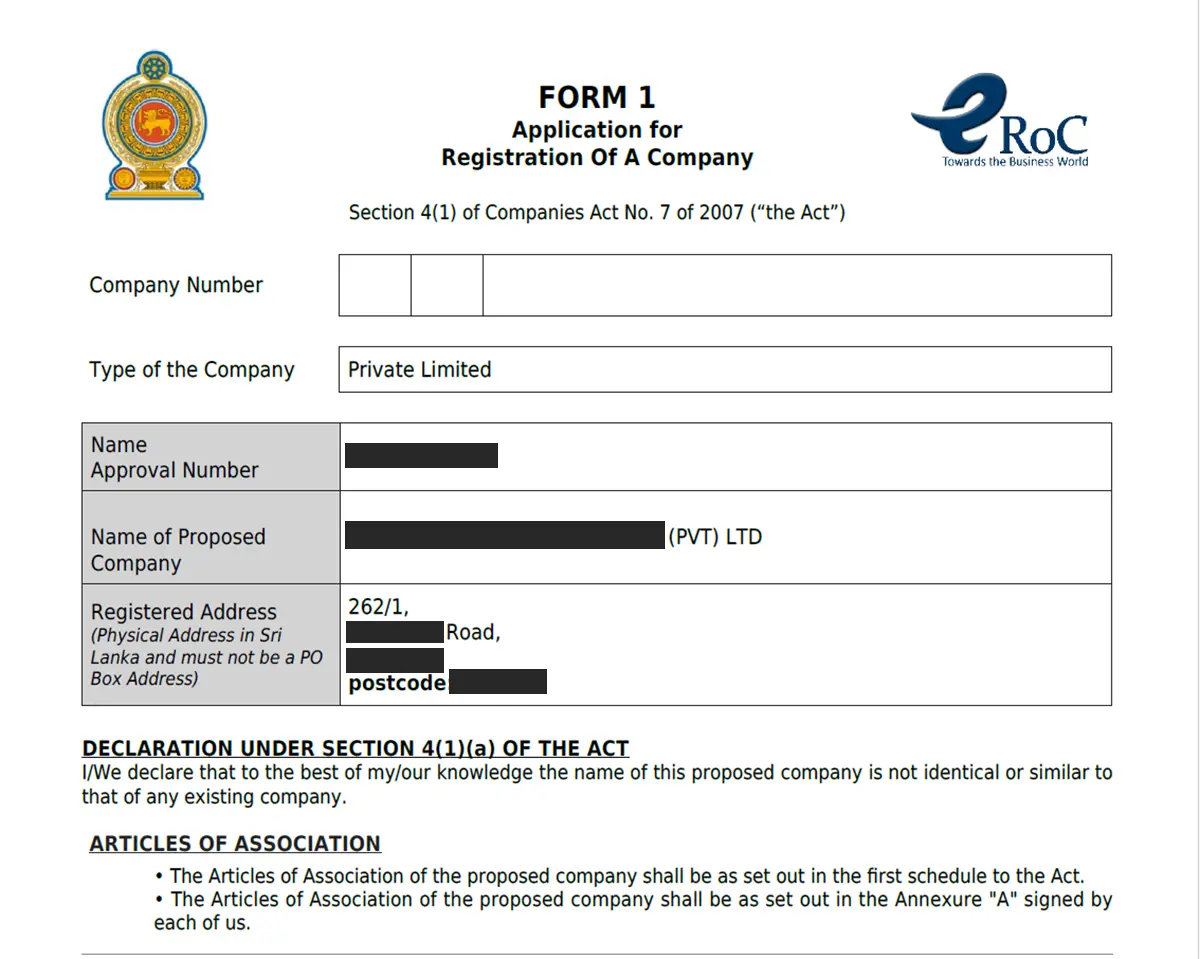

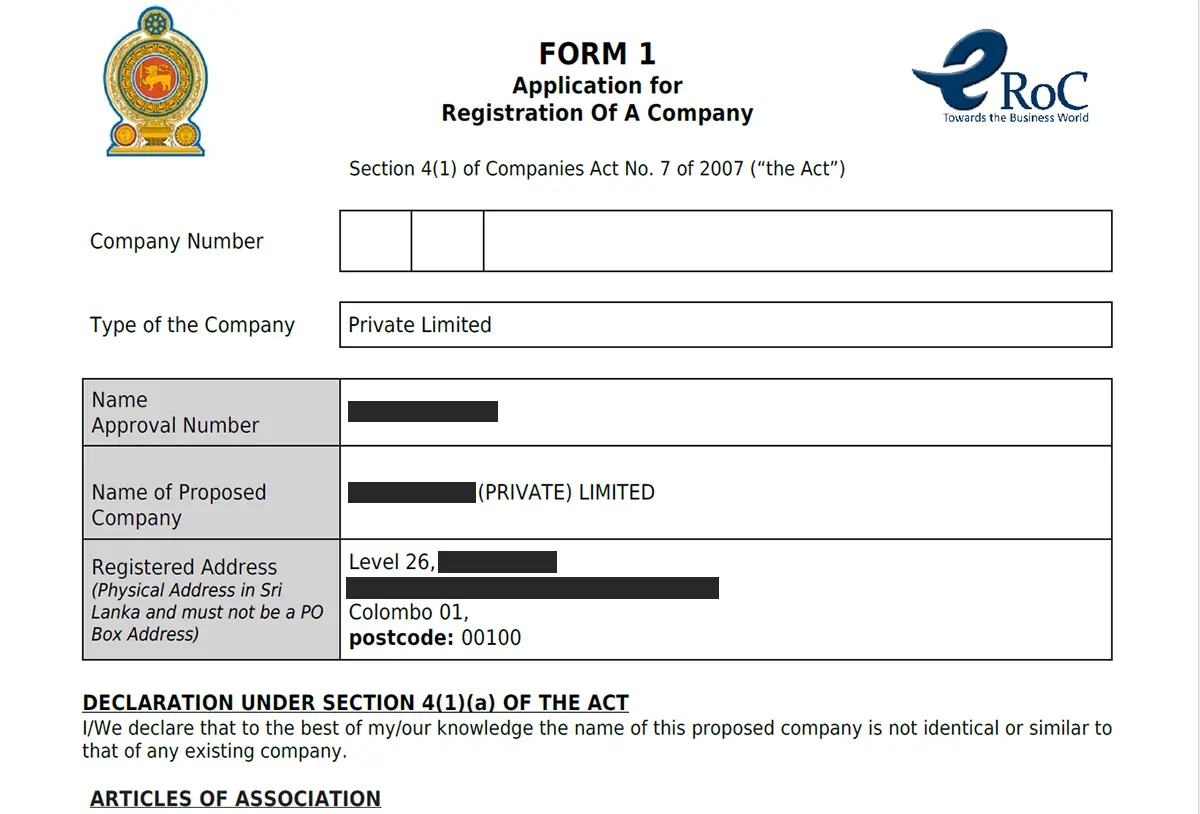

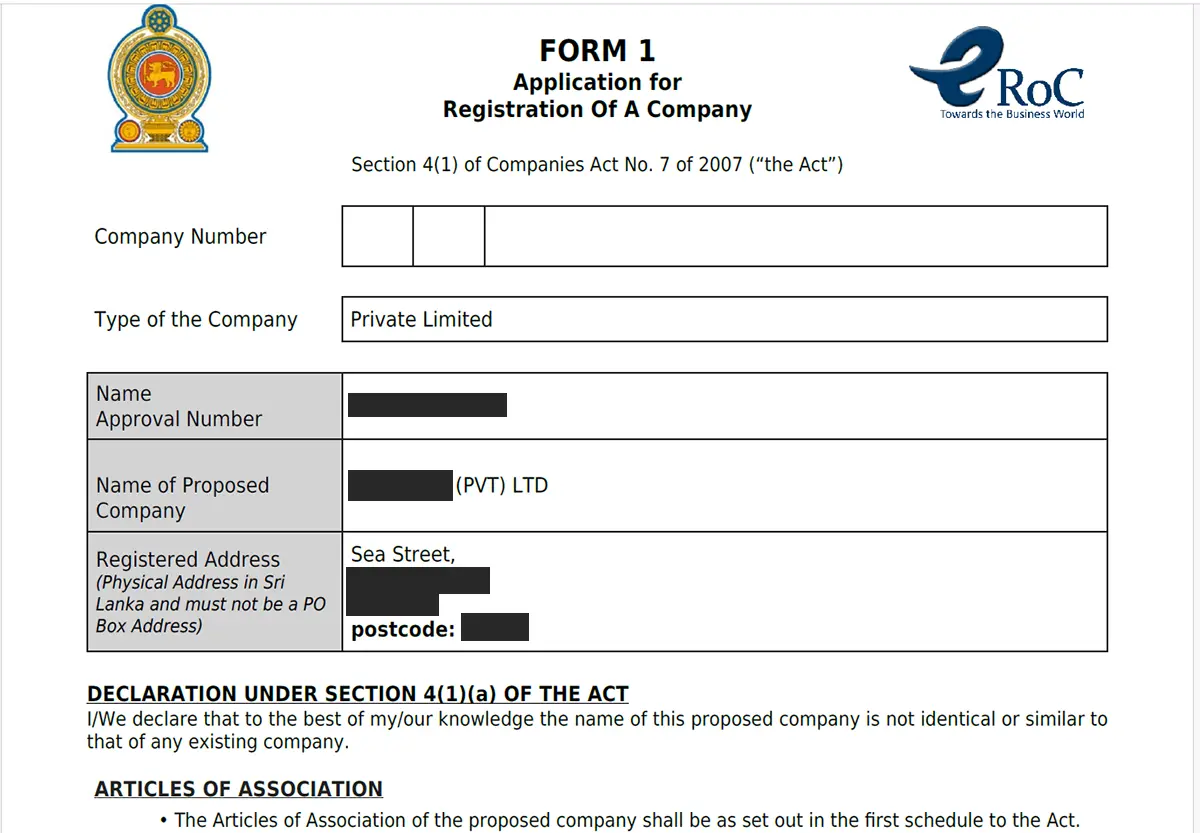

You can find your company registered office address on eROC Form 01.

Types of registered office addresses

There are three types of registered office addresses you can use to register your company.

- Home address

- Virtual office address

- Physical business address

Can I use my home address to register a company?

Yes, you can use a home address to register a company. If the home address has an assessment number or house number, you will not need further address verification documents. If the home address does not have an assessment or house number, you need to provide a utility bill that mentions the address and your name. If you do not receive utility bills for your home address to your name, you can provide Grama Niladari certificate to confirm residency.

However, here’s what you should think about:

- Your home address becomes public record

- It may look less professional for certain businesses

- Customs/IRD officers can come for inspections

Can I use a virtual address for company registration in Sri Lanka?

Yes, you can use a virtual registered office address to register a company in Sri Lanka. A virtual office address is a real physical business address where you can receive mail. However, you cannot use a PO Box for company registration.

Virtual office address is popular among IT companies, back-office companies, consultancies, and e-commerce sellers.

Does my registered office have to be a physical business address?

No. For most companies, you do not need a physical business address. For example, consultancies, IT and software, e-commerce, education, administrative and back-office services registered office address does not have to be a physical business address.

However, if you plan to operate a trading (import/export) company, a manufacturing company, or register your company with the BOI, company’s registered office address needs to be a physical business address to obtain VAT number and customs importer/exporter registration and other line agency approval.

What to consider when choosing an address for company registration

Registered office address with an assessment number

If the company is locally owned, when the registered office address has an assessment number or a unit number, you do not need to submit an address proof document. This means you can use even your friend’s or relatives’ address without address verification document.

Later if you plan to rent or lease the address, you can sign the lease in the company name after the company is registered.

Example: Level 26, West Tower, World Trade Centre, Colombo 01.

However, for VAT and Customs registration. you will need a lease/sub-lease agreement or copy of deed with supporting documents to prove ownership of premises.

Registered office address without an assessment number

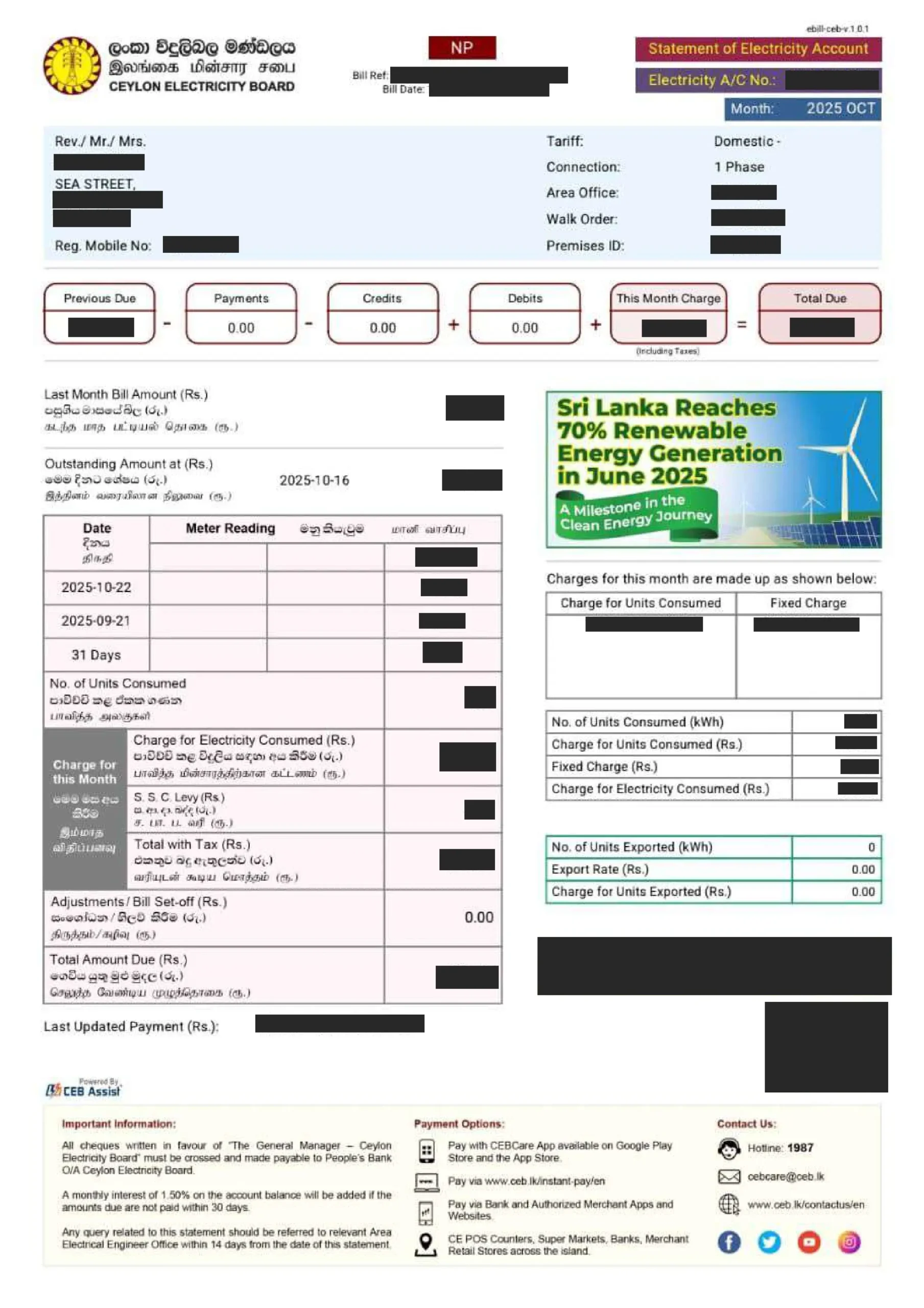

If the registered office address does not have an assessment number or unit number, Registrar of Companies (ROC) requires an address proof document. This can be an address confirmation letter from Grama Niladari or a utility bill (electricity/water/land phone) received to a director’s or shareholder’s name.

If the address is not under a director or shareholder, you can provide a No Objection Certificate (NOC) from the owner with billing proof.

Example: Sea Street, New Bazaar Road, Batticaloa.

Registered Office Address for Import/Export Companies

To register your company for VAT and Customs, an address confirmation document such as a deed, lease agreement registered with Land Registry or a rent agreement with a certified copy of the master lease agreement registered at Land Registry is mandatory.

If you use a virtual office address, you will only have a rent agreement between your company and the registered office address service provider. However, in most cases the provider does not own the property and is not willing to share a copy of their master lease agreement with the property owner. This becomes a problem during VAT and Customs registration because authorities require proof of legal occupancy of the premises. This is where many import/export companies using a virtual registered office address get stuck.

Registered Office Address for Manufacturing Companies

If you are setting up a manufacturing company, your business must operate from a physical location (factory or production site).

At the time of incorporation with the Registrar of Companies, you can use a virtual office address as the company’s registered office.

However, this is usually only a temporary solution.

When applying for line agency approval such as Ministry of Industry registration, you will need to change registered office address of the company to your factory location. To change registered office address, you will need to file Form 13 (Notice of Change of Registered Office Address) to Registrar of Companies. Once Form 13 is approved, you will need to communicate the change of address to banks, Inland Revenue Department, Labour Department, EPF Provident Fund etc.

For a manufacturing company, changing registered office address is a costly, time-consuming, and unnecessary step if the factory location is already known at the time of incorporation.

BOI incentives, concessions are linked to project site/location

The Board of Investment (BOI) cannot execute a BOI Agreement with an investor based on a virtual business address or virtual office. This is because BOI-related tax incentives and concessions are project-site specific.

BOI incentives and concessions such as import duty xemptions for machinery, infrastructure and utilities within Export Processing Zone (EPZ) equipment and enhanced capital allowances are linked to approved project site/location.

Therefore, investors applying for BOI company registration must lease out a physical business address.

Proof of registered office address is mandatory for foreign owned companies

If a company is owned by a foreign citizen or a foreign entity, or where the majority of shares are held by a foreign citizen or foreign entity, submitting an address proof document is mandatory.

This requirement applies regardless of whether the address has an assessment number or not.

What documents do I need to prove registered office address?

- Utility bill (electricity/water/land phone)

- Certified copy of Deed (if you own property) OR lease agreement OR sub-lease agreement with a certified copy of the master lease agreement

- No Objection Certificate (NOC) from the property owner

How much does a registered office address cost in Sri Lanka?

The cost of a registered office address in Sri Lanka depends on whether you plan to use a virtual office address, private office or shared office.

If you prefer a professional business address in Colombo, virtual office options typically start from

- Colombo 01 – LKR 7,500 + tax per month

- Colombo 05 – LKR 6,500 + tax per month

The Executive Centre offers virtual office subscription plans on a monthly rolling basis, and fixed-term commitments starting from 6 months.

If you require a physical private office, pricing depends on the location, office size, and facilities included. For a two-seater office at World Trade Centre, the monthly rent typically start from LKR 110,000 + taxes per month.

If you plan to lease a private office directly from the property owner in Sri Lanka, as the lessee you will typically be responsible for:

- Notary fees (to notarize the lease agreement)

- Title search costs (to confirm the owner’s ownership and rights)

- Stamp Duty on the lease agreement (Rs. 20 for every Rs. 1,000 of the total rent over the lease period)

Can I use a PO Box as a registered office address in Sri Lanka?

No. The Registrar of Companies does not accept PO Box addresses.

Can I change my company registered office address later?

Yes, to change your company registered office address, you must file Form 13 with the Registrar of Companies.

Is a lease agreement mandatory for VAT registration?

Yes. For VAT and Customs registration, certified copy of duly notarized lease agreement registered at the Land Registry (if you rented/leased the address) or certified copy of deed (if you own the address) is required.

Is an address proof document mandatory for foreign-owned companies when registering a company in Sri Lanka?

Yes. For foreign-owned companies, an address proof document is mandatory regardless of whether the registered office is a virtual or physical address, and whether the address has an assessment number.