The first step to registering a business in Sri Lanka is choosing the right legal structure-sole proprietorship, partnership, or private limited company. Next, do a name search and register your business name with the relevant Divisional Secretariat or the Registrar of Companies (ROC). Once you receive the Business Registration Certificate (BRC), apply for the required business licenses and obtain a Tax Identification Number (TIN) within 30 days of registration.

Whether you are a small business owner, budding entrepreneur, freelancer, creator or foreign investor, this step-by-step guide has everything you need to know about how to register a business in Sri Lanka.

Where and how to register a business in Sri Lanka depends on the type of business registration or business structure. For partnership or individual business registration, it’s the relevant Divisional Secretariat where you need to register your business. Online business registration isn’t available for sole proprietorships and partnerships. You can register a company in Sri Lanka online with Registrar of Companies using the eROC login (eroc.drc.gov.lk).

Table of Contents

How to Register a Business in Sri Lanka in 4 Simple Steps?

Here’s how to register a business in Sri Lanka in just 4 easy steps—it’s simpler than you think!

- Choose the right type of business structure

- Pick a unique name for your business name registration

- Apply for business licenses and permits

- Apply for TIN registration online

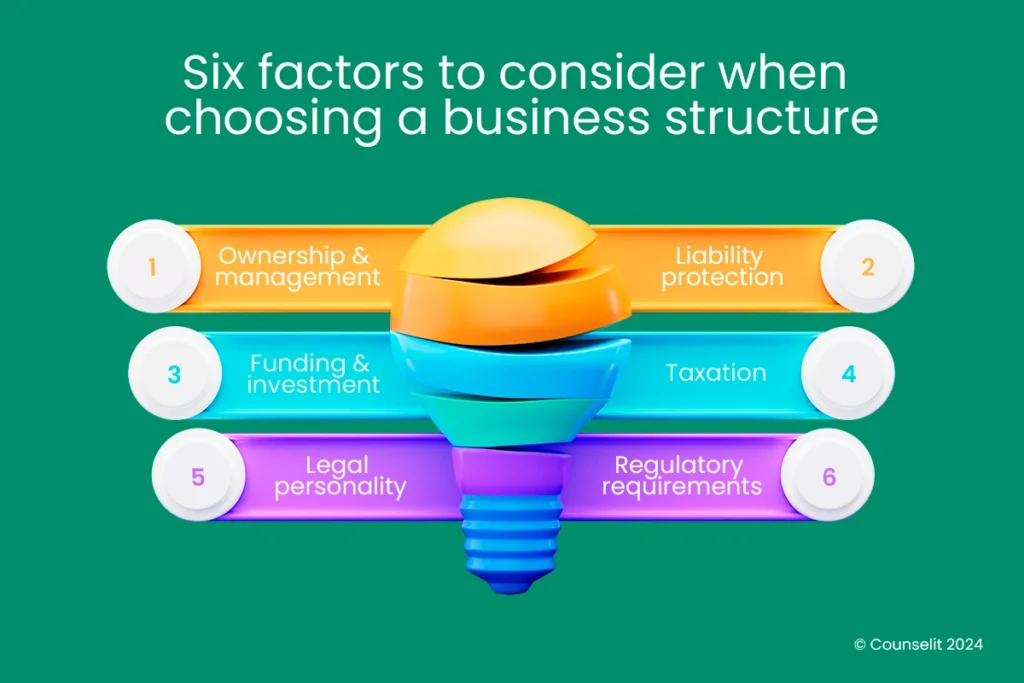

1. Choose the right type of business structure

If you’re thinking about how to register a business in Sri Lanka, one of the first things you’ll need to consider is choosing a legal structure for your business. There are five main business structures to choose from depending on factors like ownership, liability protection, management and control, initial capital, taxation, legal status, and several other important considerations.

- Individual business registration (sole proprietor/sole trader)

- Partnerships

- Limited liability companies (Private limited companies, public limited companies, and companies limited by guarantee)

- Off-shore companies

- Overseas companies

Register a private limited company in Sri Lanka starting from 16,990 LKR. Sign up for our Premium year-round Compliance plan to enjoy significant savings with the annual Registered Company Secretarial services package.

How to register a business in Sri Lanka as a sole proprietorship?

Sole proprietorship or individual business registration is the simplest and most basic type of business structure. The entire business is owned and operated by a single individual. Some of the most popular brands like Coca-Cola, Walt Disney, and Amazon also started their business as sole proprietorships. So it’s a good starting point for anyone who wants to register a small business in Sri Lanka and start operations immediately to register their business as a sole proprietorship.

However, one drawback of registering a sole proprietorship is that it is not a separate legal entity. This means you and your business are the same person. As the owner, you’ll be personally liable for all your business debts and taxes.

What is the income tax rate for sole proprietorship in Sri Lanka?

For tax purposes, the income generated from a sole proprietorship is considered your personal income. The same tax rates and thresholds as applicable for individual income tax (IIT) will apply. For the first 500,000 Rupees of your taxable income is taxed at 6%. Unlike companies, you won’t have to pay corporate income tax.

What is the tax free allowance in Sri Lanka?

As an individual business owner, you are entitled to 1.2 million personal income tax relief (tax-free allowance) that you would not otherwise be entitled to if you were a partnership business or company. This is one major tax benefit of sole proprietorships many business owners overlook when comparing different business structures.

Now let’s look at how to register a business in Sri Lanka as a sole proprietorship. Individual business registration in Sri Lanka is an easy 3-step process. Let’s break it down step-by-step.

Step 1: Obtain the necessary Business Registration Application Forms

Where can I get a business registration form?

Visit the relevant Divisional Secretariat where your business place is located and let them know your intention to register as a sole proprietorship. Then you’ll be provided with the application for registration of a business name of an individual business (Business Name Registration Form/ BNR – 01 Format). This is the form that is used to register the name under which your business will operate. You can choose to register under your name or a fictitious name. You can do a simple business registration name check online before you pick a business name.

You should sign the BNR form in your name as the business owner. Do not sign by the name of your business.

Step 2: Submit the documents required for Individual Business Name Registration

After you sign, submit the following documents along with the completed Business Registration Application Form.

- True Copy of your National Identity Card or passport or driver’s license certified by Grama Niladhari

- Report of the Grama Niladhari asserting your business is being carried on and this should be countersigned by the Divisional Secretary

- If you reside in a different area from your business premises, a residency certificate issued by Grama Niladhari

- A copy of the trade license issued by the relevant municipal council/local council.

- Documents confirming ownership of business premises

- If the business premises is owned by you, a true copy of the deed of transfer or title certificate (certified by a Notary Public) must be submitted. If the deed is subject to the life interest of another person, a letter confirming that they have no objection to the operation of the business must be signed in front of the Grama Niladhari, along with a certified copy of the document verifying this. If the business is being operated under a lease agreement, a certified copy of the registered agreement (certified by a Notary Public) must be submitted. The original copies of the deed/ lease agreement must also be submitted (the original copy will be compared and returned). If the deed related to the business premises is mortgaged to any bank/financial institution, a certified copy from that institution and a letter confirming that there is no objection to the operation of the business must be submitted.

- If a business premises is operated solely with the consent of the owner, in addition to a certified copy of the deed, a letter of consent and a copy of the national identity card (certified by the Grama Niladhari) must also be submitted.

- Rates Assessment Notice to confirm the address of the business premises.

- Affidavit Confirming Initial Capital declaring the initial capital investment in your business.

- An affidavit confirming the address of the business premises is the same location as stated in the relevant deed/ lease agreement.

- Clearly and properly outline all activities related to the business you conduct as the nature of the business. It should be clearly stated whether your business is an import, export, or manufacturing business.

Step 3: Collect Business Registration Certificate

Once you’ve filed all the required documents and paid the business registration fees, you’ll receive a Certificate of Registration of Business Name from the Divisional Secretary. Once your business is registered, make sure to display your business registration certificate at your business location.

There you have it, that’s how to register a business in Sri Lanka as a sole proprietorship. Simple as that!

How to register a business in Sri Lanka as a partnership?

A Partnership is where two or more people or entities come together to do a business agreeing to share the risks, profits, and losses. You can form a partnership either verbally, impliedly, or in writing (partnership agreement). However, section 519 of the Companies Act limits the number of partners to 20. But then just like in sole proprietorship, each partner is personally liable for the partnership’s debts.

Microsoft, McDonald’s, Google, YouTube, and Google are some of the big brands that started as partnerships. Partnerships are a popular legal structure for businesses like law firms, real estate agencies, accounting firms, physician groups, and consulting businesses.

Forming a partnership can be a great choice if you’re starting a business with a friend or colleague, or if you have a business partner.

So, let’s look at how to register a business in Sri Lanka as a partnership.

Step 1: Fill out the necessary business registration forms

Visit the relevant Divisional Secretariat Office where your business is located and obtain an application for the registration of business name of a partnership business BNR-03. You will be required to fill in your business name, date of commencement of business, principal place of business, initial capital, full names, birth dates, place of residence, contact details, and signatures of all the partners. The application form includes an affidavit and a statement of declaration. This should be signed in the partners’ names, not the partnership’s name. Partners must confirm the information in the application form using separate affidavits/ statements of declaration.

Step 2: Submit documents for registering a partnership business in Sri Lanka

With the application form, you should submit the following documents.

- True copies of National Identity Card or Valid Passport or Valid Driving License of all partners

- Report of the Grama Niladhari asserting that the business is being carried on (countersigned by the Divisional Secretary)

- The copy signed by a Notary Public of the deed or lease agreement or tenancy agreement affirming the transfer of ownership of the place of business. Where the ownership is assigned to another party by a deed regarding the place of business, an affidavit or statement of declaration to the effect that legal permission will be/ has been provided by the party owning the property to the applicant regarding the property in question to register the business name, and, a true copy of the National Identity Card or valid Passport or valid Driving License of the party owning the property.

- Trade Permit: Obtain a trade permit from the nearest Municipal Council or Divisional Council.

- The original of the partnership agreement.

- Affidavits/statements of declarations submitted separately by all the partners to prove the information declared in the application form

Step 3: Obtain business registration certificate

Once you have all the required documents, submit them to the Divisional Secretariat Office and pay the registration fees. They will review your application and issue a certificate of registration for your partnership business.

And there you have it—now you know how to register a business in Sri Lanka as a partnership!

Next, we’ll look at how to register a business in Sri Lanka as a company.

How to register a company in Sri Lanka?

You can now register a company in Sri Lanka online through the eROC website– you no longer need to visit the Registrar of Companies (or Samagam Medura, as it’s commonly called) in person. The process for incorporating guarantee companies, public limited companies, and private limited companies in Sri Lanka is pretty similar.

Unlike sole proprietorships and partnerships, a company is a separate legal entity from its owners. This is known as ‘limited liability protection’. As a shareholder, your personal assets are generally shielded from the company’s debts. Companies are also taxed separately from their shareholders.

If you’re wondering how to register a business in Sri Lanka as a company, the Companies Act No. 7 of 2007 gives you three main options: private limited companies, public limited companies, and companies limited by guarantee. A private or public limited company can be incorporated with just one shareholder, except for guarantee companies. In fact, even a single individual can register a company in Sri Lanka. It’s called a ‘one-person company’.

- Private limited companies cannot invite the public to subscribe to their shares or other securities. Therefore they are more suitable for single-owner or family-owned businesses. A Pvt Ltd company can be registered in Sri Lanka with just one shareholder but cannot have more than fifty shareholders. You’ll need at least one shareholder and one director, and they can be the same person. However, one person can’t hold all three roles: shareholder, director, and company secretary.

- A public limited company or PLC is a type of company that is publicly traded on a stock exchange. It’s suitable for larger businesses that require significant capital investment through shares issued to the public. Even a single shareholder can incorporate a public limited company and there is no upper limit to the number of shareholders. Unlike Pvt Ltd companies, a PLC must have at least two directors. Public companies can invite public subscriptions for their shares or debentures and other securities, and can also be listed on the stock exchange.

- A company limited by guarantee is an association or non-profit organization where members undertake to contribute to the assets of the company in the event the company goes into liquidation. These companies do not issue shares. Guarantee companies are commonly used for charitable or community-based organizations.

Let’s take a step-by-step look at how to register a business in Sri Lanka as a company.

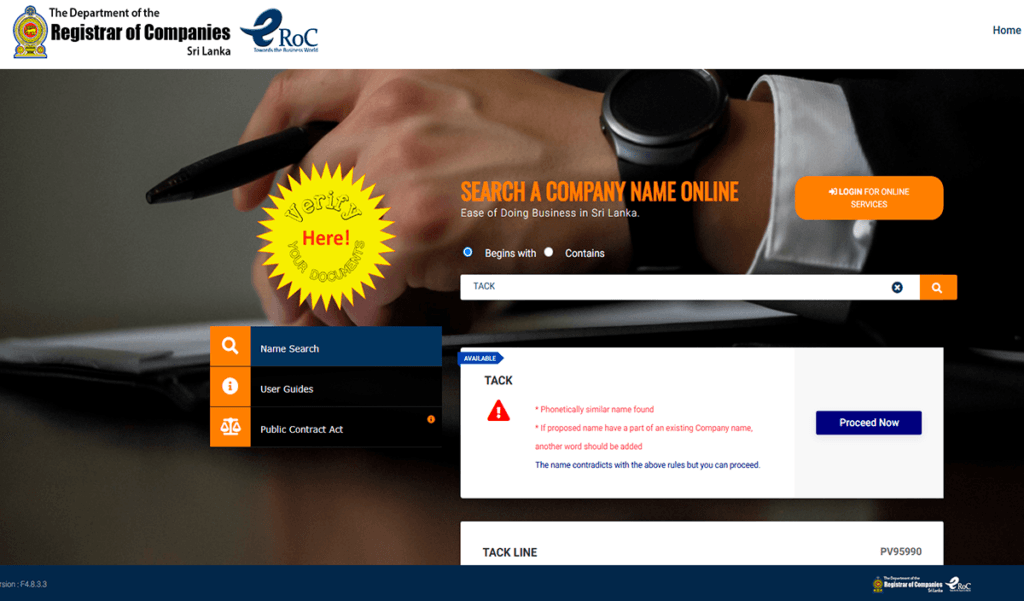

1. Company registration Sri Lanka name check (eROC name search).

To do an eROC name search, simply visit eROC Sri Lanka website via https://eroc.drc.gov.lk/home/search. You can search for available company names without eROC online registration.

Once you’re on the eROC Sri Lanka home page, type your desired company name in the search bar. This way, you can find out if an existing company is already using that name for their company. You can type in only part of the name by clicking the ‘begins with’ option or the full name by using the option ‘Contains’.

If the name is available, you can simply ignore the warning message and proceed to submit the name reservation application to reserve your company name. To submit your name reservation application, you need to register with eROC Sri Lanka by creating a new user account. If you are already a registered user, you can start the application process immediately.

2. Obtain a name approval.

Once you submit your name reservation application, eROC will review it to make sure it doesn’t violate any rules. If your company name is unique and does not fall under any of the restrictions on names listed in section 7 of the Companies Act, they will approve your name reservation application. It should be approved within 5 business days. If your company name is identical to the name of any existing company or overseas company registered in Sri Lanka, or contains the words “Chamber of Commerce” (unless you intend to register as a company limited by guarantee), or is misleading in the opinion of the Registrar of Companies, your company name will be rejected and you’ll need to choose a different name and resubmit your application.

Once name approval is granted you will receive an email from eROC with a link to start the incorporation process. But remember, your name reservation is valid for only three months. So make sure you register your company within this three-month time frame.

3. Negotiate with a Registered Company Secretary.

You need to submit Form 19 with eROC when you register a company. Form 19 is the Secretary consent form where a Company Secretary agrees to act as your company’s secretary. Make sure you retain the services of a Registered Company Secretary who has a valid “Certificate of Practice” from the Department of Registrar of Companies.

Counselit Company Secretaries are Registered Company Secretaries and can assist you in drafting your articles of association customized to your business goals and guide you through the pre-incorporation and post-incorporation processes to ensure 100% legal compliance.

4. Choose an address for the company registered office.

Your company’s address will need to go on Form 01, the application form for registering a company in Sri Lanka. Therefore you’ll need to obtain an address for your company’s registered office before you start the registration process.

If you’re planning to start an e-commerce store or online business, you might be wondering whether you can register a private limited company without a physical office. The good news is, yes! You can register an online business as a company!

What is the best way to register an online business in Sri Lanka?

You can register an online business as a Pvt Ltd company using your home address. Your company’s registered address doesn’t have to be the same as your business location. This means your company’s address can be your personal address, a company director’s address, or that of a friend or relative. You can even use a virtual office address. Remember all official correspondence from third parties including from banks, the Department of Registrar of Companies, the Inland Revenue Department, and other regulatory authorities will be sent to your company’s registered address.

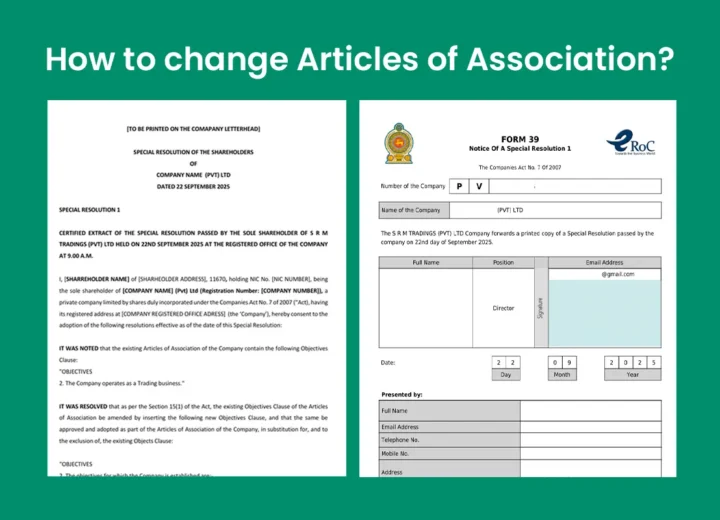

5. Draft Articles of Association

Why do you need an Articles of Association?

The Articles of Association is the foundation of your company. It is a contract between the company and each shareholder. Articles outline how your company will be managed, controlled, and operated. The Companies Act No. 7 of 2007 has minimized the documents required for incorporation of a company in Sri Lanka from the standard two documents: a memorandum of association and articles of association to one document, namely the articles of association. Your Company secretary will assist you in drafting the articles to suit your business needs.

What features do you need to include in your articles of association?

For Private Limited Companies, an objects clause is not mandatory. The same goes for public limited companies. However, if you’re registering a company limited by guarantee, your articles should specify the company objectives. Additionally, if there are foreign shareholders in your company, the business activities of your company will be subject to the Foreign Exchange Act and regulations.

In your articles, you can prescribe the minimum and maximum number of directors, the procedure for appointment and removal of directors, the appointment of a chairperson, the method of holding board meetings, the quorum for board meetings, the casting of votes, use of the company seal, how board resolutions should be passed, remuneration of directors, reserves, and distributions, share issue and transfer, accounting, auditing and other managerial affairs of the company.

If you’re registering a pvt ltd company in Sri Lanka, be sure to include provisions in your articles that prohibit the company from offering shares or other securities to the public; and limit the number of its shareholders to fifty, excluding employees or former employees who became shareholders during their employment and continue to hold shares after ceasing to be employees of the company.

At the bottom of the final page of the Articles of Association, each initial shareholder should sign and date alongside their full name and NIC number confirming their agreement with the Articles of Association.

6. Fill out company incorporation forms (eROC forms).

- Form 1 Companies Act: Application for Registration of a Company

- Form 18 Companies Act: Consent and Certificate of the Director (Signed by each director)

- Form 19 Companies Act: Consent and Certificate of the Secretary/Secretaries (signed by each secretary)

7. Upload a scanned copy of the Articles of Association.

Your articles of association can be drafted based on Model Articles set out in the First Schedule of the Companies Act No. 7 of 2007. You’re free to adopt the model articles or modify them as needed. The model articles can be adopted by any companies other than companies limited by guarantee.

8. Upload the eROC forms and identity documents.

Upload scanned copies of the duly signed eROC forms and NIC/Passport/Driver’s license of Shareholders and Directors to the e-ROC system and pay online company registration fees.

If the information provided in eROC forms and Articles is verified as correct, the Registrar of Companies will approve your company registration application. You will then receive the business registration number and the business registration certificate online via email.

Please not that in private limited company registration, it is no longer necessary to publish the notice of incorporation in the gazette or newspapers.

And that’s how to register a business in Sri Lanka as a company! It’s really that simple.

How to register a business in Sri Lanka as an off-shore company?

Both local and international companies incorporated in or outside Sri Lanka can register as off-shore companies. These companies are allowed to do business outside Sri Lanka but they cannot engage in any business activity within the country.

If you’re looking to understand how to register a business in Sri Lanka as an off-shore company, the process is fairly simple. Let’s break down how to register a business in Sri Lanka as an off-shore company.

Steps to register an off-shore company in Sri Lanka

Step 1: eROC name search

Step 2: Obtain eROC name approval

Step 3: Hire a Registered Company Secretary in Sri Lanka

Step 4: Choose an address for the company-registered office

Step 5: Submit documents required for registration of an off-shore company

(a) a certified copy of the charter, statute, or memorandum and articles of association of the company.

(b) list of directors or those managing the affairs of the company with their full names, addresses, occupations, and the offices they hold in the company (Form 45)

(c) the names and addresses of one or more persons who are resident in and are citizens of Sri Lanka who is or are authorized to represent the company (Form 46)

(d) statement containing the full address of

(i) the registered or principal office of the company in the country of incorporation;

(ii) the office of the company in Sri Lanka (Form 44)

(iii) a certified copy (certified of recent date) of the incorporation of the company.

(e) a valid Power of Attorney (authenticated by the seal of the company) authorizing the persons, or person resident in Sri Lanka to act on behalf of the company.

Step 6: Obtain a bank certificate to confirm that your company has paid the prescribed fee of USD 100,000.

Off-shore companies must deposit an annual renewal fee of $100,000 to the credit of a bank account in the name of the company and produce to the Department of Registrar of Companies a bank certificate to that effect. This fee is to cover the expenses of running your off-shore company’s office in Sri Lanka.

Now you know how to register a business in Sri Lanka as an offshore company. Let’s look at the procedure to register an overseas company.

How to register a business in Sri Lanka as an overseas company?

Only a foreign company incorporated outside Sri Lanka can register as an Overseas Company in Sri Lanka. To register as an overseas company, your company must meet the following two conditions,

- obtain permission to do business in Sri Lanka under the Exchange Control Act, subject to exclusions, limitations, and conditions published in Government Gazette No. 2213/35 of 03.02.2021 under the Foreign Exchange Act No. 12 of 2017.

- establish a place of business within Sri Lanka which includes a share transfer or share registration office.

Foreign companies cannot set up a business in Sri Lanka or register as an overseas company if their business activities do not comply with the Exchange Control Act regulations.

Steps to register an overseas company in Sri Lanka

Here’s how to register a business in Sri Lanka as an overseas company—step by step.

Step 1: eROC name search

Step 2: Obtain eROC name approval

Step 3: Engage the services of a Registered Company Secretary in Sri Lanka

Step 4: Choose an address for the company-registered office

Step 5: Submit documents required for registration of an overseas company

Within one month of establishing its place of business within Sri Lanka, you must submit the following documents to the Department of Registrar of Companies for registration as an overseas company.

(i) a certified copy of the charter, statute, or memorandum and articles of association of the company.

(ii) a list of the directors of the company (Form 45)

(iii) the names and addresses of one or more persons resident in Sri Lanka authorized to accept on behalf of the company, service of documents and any notice required to be served on the company (Form 46)

(iv) a statement containing the full address of the registered or principal office of the company in the country of origin and the principal place of business of the company within Sri Lanka (Form 44)

(v) a certified copy, certified of recent date, of any document affecting or evidencing the incorporation of the company; and

(vi) a valid Power of Attorney authenticated by the seal of the company authorizing the persons, or person resident in Sri Lanka to act on behalf of the company.

The documents you submit must be true copies of the originals certified by:

- A government official in the country where the original document is kept

- A Notary Public in that country

- A company officer, before a person having authority to administer an oath in that country

- Once the document is certified, the signatures or seals of that government official, Notary Public or person having authority to administer an oath needs to be further authenticated by an official of the Sri Lankan Embassy or High Commissioner in that country. Where there is no Sri Lankan Embassy the signatures may be authenticated by:

- Trade Commissioner

- A Sri Lankan government representative in that country

- A member of the judiciary in that country

- Or any other person acceptable to the Registrar General of Companies.

Now you know how to register a business in Sri Lanka as an overseas company.

2. Pick a unique name for your business registration

Once you’ve decided on the right legal structure to register your business in Sri Lanka, the next step is to pick a unique name for your business. Knowing how to register a business in Sri Lanka, whether as a sole proprietorship or company, requires understanding the legal requirements for business names.

According to the Business Names Act, No. 7 of 1987, it is mandatory for every individual, firm, or corporation having a place of business in Sri Lanka operating under a business name that does not consist of the full names of the partners or individuals or true corporate name to register their business name.

To name your business, you’ll need to perform a basic business registration name check. First, do a quick Google search to check for similar names. Then, check with the Divisional Secretary office and look through local business listing sites to see if your chosen name is already registered.

Sole proprietor and partnership business registration name check

According to Western Provincial Business Names of Business Corporations of Non-Incorporated Business Establishments Statute No. 05 of 2011, you must register your business name within 14 days or a maximum of 30 days from the commencement of business.

You cannot include terms such as private company, group business, foundation, office, organization, association, consortium, business owners’ collective, charitable service, international school, society, board, center, group, international collaboration, or any such misleading terms in your business name registration application for sole proprietorship or partnership.

Company name search in Sri Lanka

Anyone who wishes to register a company name must first search the eROC database for registered company names. Once you enter your desired company name, if the name is already taken, the eROC name search will show a warning message “Phonetically similar name found”.

A name is phonetically similar when it sounds the same or very close to another name. It doesn’t matter how they’re spelled. For example, the brand names “Kleen” and “Clean” are phonetically similar. They sound the same, though they’re spelled differently.

The search will show you a list of company names that are phonetically similar or contain the exact same name. For example, if you want to name your business “Tack,” you’ll see that “Tack Line” is already taken. You can still apply for “Tack” or add another word to it, like “Tack Media”. However, we recommend that you rebrand or choose a different name for trademark reasons.

eROC name search

If your company name is available you can proceed with your name reservation application and pay the fees. Keep in mind that the name reservation is only valid for three months from the date of approval.

The point is, you cannot register a company under a name that is identical to or so similar to the name of an existing company that it could mislead or deceive unless the existing company is being dissolved and has given its consent.

Also, your company name cannot include the following words without the consent of the Minister:

- ‘President’ or ‘Presidential,’ or any term that suggests, in the Registrar’s opinion, a connection to the President or the Government or any Government department;

- ‘Municipal’ or ‘Incorporated,’ or any term that suggests, in the Registrar’s opinion, a connection to any municipality or local authority, or any society or body incorporated by an Act of Parliament;

- ‘Co-operative’ or ‘Society’;

- ‘National,’ ‘State,’ or ‘Sri Lanka,’ or any term that suggests, in the Registrar’s opinion, a connection to the Government or any of its departments.

If you’re a Private limited company, your company can have its name end with the words (Private) Limited or abbreviation (Pvt) Ltd. Public limited companies can include ‘Public Limited Company’ or ‘PLC’ at the end of their names. Guarantee companies and associations can have their names end with the word “Limited” or abbreviation “Ltd” or “(Guarantee) Limited”.

Once your company is registered, be sure to include your company name and business registration number in all business letters, notices and publications, legal notices including invoices and receipts, all documents issued by your company, and in the company seal. Plus, display your company name and business registration number at your registered office.

Pro Tip: If you wish to use your business name as your brand, it’s advisable to register your brand name or logo as a trademark with the National Intellectual Property Office of Sri Lanka. This way, no other business can use your business name or brand. You will be protected from trademark infringement. You can learn more about why your business needs a registered trademark and the benefits of brand registration by checking out this guide on brand name registration in Sri Lanka.

At Counselit our registered trademark agents can help you perform a comprehensive trademark clearance search and choose a business name that qualifies for business name registration and trademark registration in Sri Lanka. Start your brand registration today and get the best value for your money with our trademark registration fee plans, starting from 18990 LKR.

3. Apply for business licenses and permits

When you register your business with the Divisional Secretariat or register your company online, you’ll be asked to submit business registration forms along with necessary certifications, approvals, licenses, or permits from the relevant regulatory bodies depending on the nature of your business activity. For example, if your company’s articles mention objects relating to financial services, you need to obtain prior approval from the Central Bank of Sri Lanka(CBSL). Similarly, if you’re starting a medical laboratory, you will need prior registration with the Private Health Services Regulatory Council and Sri Lanka Medical Council.

Here’s a list of the business licenses and permits you’ll need.

| Nature of Business | Required documents and recommendations |

| Ayurvedic-related Dispensaries, Hospitals, Clinics, Pharmacies, Drug Stores, Medicinal Plant Nurseries and Related Businesses | recommendation from the Commissioner General of Excise |

| Gem and jewelry sales and manufacturing business | recommendation from National Gem & Jewellery Authority(in the name of the business or in the personal name) |

| In situations where it is necessary to fulfill vocational requirements for a business | certified copies of qualifications/certifications issued in the business owner’s personal name |

| Cigarettes, pipes, tobacco, cigars, beedis- raw materials and finished products manufacturing, storage for import, export | certification from the Sri Lanka Medical Council |

| Pharmacies | recommendation from the Provincial Nursery Director |

| Consultancy | relevant field-specific qualifications |

| Nursery | report of the Divisional Secretary, with the recommendation of Grama Niladhari certifying the absence of public objections, along with the police clearance report regarding the relevant location and the owners. |

| recommendation from the Early Childhood Development Assistant from the relevant divisional secretariat countersigned by the Divisional Secretariat | Day care centers |

| Gas station | Recommendation from the Central Environmental Authority (CEA) and approval of the Ceylon Petroleum Corporation (CPC) |

| Beauty parlors, clinics, and perfume retailers. | recommendation from the Provincial Director of Health Services or a public health inspector, along with a certificate confirming professional qualifications. |

| Storage, sale, and other related industries of polyethylene, plastic, paint, and acid products. | recommendation from the Central Environment Authority |

| Timber-related industries, timber cutting, timber transportation, and carpentry businesses. | Recommendation from the Department of Forest Conservation |

| Printing business | National Archives Department recommendation |

| Room and accommodation services, guest houses, massage centers. | registration certificate from the District factory inspection Engineer’s offices |

| manpower supply and parking management business | Police clearance report obtained in the name of the owners |

| child, elder, and disabled care centers | the recommendation of the Provincial Director of Social Services |

| Animal farms | recommendation from the veterinary officer |

| Breeding and sale of ornamental fish | recommendation from the Public Health Inspector |

| Beverage or food business | recommendation from the Public Health Inspector |

| Driving schools | registration certificate from the Department of Motor Traffic |

| Import and sale of communication devices using SIM cards | registration from the Telecommunications Regulatory Commission |

| Import and sale of pesticides, insecticides, and chemical fertilizers | recommendation from the Director General of Agriculture |

| Import, production, and sale of compost fertilizer | license from the National Fertilizer Secretariat |

| Vehicle service stations and garages | recommendation from the Central Environmental Authority |

| If working as a sales representative for any agency/organization | a letter confirming appointment as a representative of that agency/organization |

| Foreign employment agencies | recommendation from the Private Health Services Regulatory Council |

| TV, radio, cable, satellite, YouTube channel related businesses | recommendation from the Ministry of Mass Media |

| Importing, selling, presenting for sale, or repairing telecommunication equipment | registration with the Telecommunications Regulatory Commission (mandatory when submitting the statement of changes) |

| For construction sites such as firecracker factories | the police clearance report obtained in the owner’s name at the time of initial registration is sufficient. A valid license from the Foreign Employment Bureau is mandatory when submitting the statement of changes |

| Online business registration in Sri Lanka | a police clearance report in the name of the applicant or applicants, along with any other recommendations that should be obtained based on the nature of the business. |

| Film and teledrama production | a police clearance report in the name of the applicant or applicants |

| Soap production | quality certification from an accredited institution and a public health inspector’s report. |

| Foreign education and visa consultancy coordination | a police clearance report in the name of the applicant or applicants, along with copies of agreements with relevant foreign institutions |

| Seedling nursery | recommendation from the Agricultural Department by the Agricultural Officer under the Seed Act. |

| Businesses related to the health sector – for example, private hospitals, private medical clinics, private medical laboratories, private ambulance services, full-time private medical services, part-time private medical services, full-time dental clinics, part-time dental clinics, full-time specialized medical services, part-time specialized medical services, and other private medical institutions | recommendation from Private Health Services Regulatory Council |

| Pawning businesses (gold items, vehicles, electrical appliances) | the police clearance report obtained in the owner’s name at the time of initial registration |

| Additionally, any other documents called for by the company registrar of Sri Lanka as required | |

At Counselit our experienced business consultants are here to assist you in obtaining the necessary business licenses and permits, simplifying the application process to help you register your business and start operations successfully.

4. Apply for TIN registration online

Who should open a tax file in Sri Lanka?

Once registered, every partnership business and company must obtain a TIN number registration.

If you’re a sole proprietor and already have a personal TIN, your sole proprietor business will be registered for income tax under the same TIN number. You can register multiple sole proprietorships under your personal TIN. However, keep in mind this can increase your income tax liability, and you’ll be taxed at higher tax rates. Therefore, it’s advisable to consult with your business attorney or tax consultant to see if forming a partnership business or registering a Private Limited Company might be a better option for you.

How to get TIN number in Sri Lanka?

You can apply for TIN number online via IRD TIN Registration online portal (www.ird.gov.lk) or apply in person by visiting the Taxpayer Service Center at the Inland Revenue Department’s Head Office or any Regional Office.

To register for tax online log in to the IRD eservices portal. Fill out the online form and upload scanned copies of your original business registration forms, proof of address, and identification documents. Make sure to sign the TIN application as the business proprietor, partner, director, or power of attorney holder. If you have a partnership or multiple directors, everyone needs to sign.

Documents required for online TIN registration in Sri Lanka

Sole proprietors and Partnership Businesses

- Business registration certificate

- NIC/Driving License/Valid Passport/Senior Citizens Identity Card of the proprietor or partners

- Address Proof Document (Electricity Bill/Water Bill/Landline Telephone Bill/Bank Statement/Bank Passbook or Grama Niladari Certificate) if the permanent address is mismatched with the NIC.

- For foreigners, a valid Passport and address proof document for the local address

Limited Liability Companies

- Certificate of Incorporation

- Certified copy of eROC form 01 issued by the Register of Companies

- Certified copy of Articles of Association issued by the Register of Companies

- Change of Directors (Form 20/Form 18), Change of Address (Form 13) certified by the Company Registrar of Sri Laka (if applicable)

- Scanned Copies of the NIC/Driving License/Valid Passports with NIC number/ Senior Citizens Identity Card of the Directors (certified copies)

- BOI Registration certificate and BOI Agreement (For BOI companies)

To learn more about the process for IRD TIN registration online, check out our blog article on how to register TIN number online.

Company Limited by Guarantee

- Certificate of Incorporation

- A certified copy of Form 5 issued by the Company Registrar in Sri Laka

- Articles of Association with signatures of initial shareholders

- Change of Directors (Form 20/Form 18), Change of Address (Form 13) certified by the Company Registrar in Sri Laka (if applicable)

- NIC/Driving License/Valid Passports with NIC number/ Senior Citizens Identity Card of the Directors (certified copies)

Overseas companies

- Certificate of Incorporation – Form 42

- Full Address of the Registered or Principal Office of the Company (Form 44) – certified by the Company Registrar in Sri Laka

- List of particulars of the Directors of a Company (Form 45)

- List of the Names and Addresses of persons residing in Sri Lanka authorized to accept service on behalf of the Company (Form 46)

- Articles of Association with signatures of the initial shareholders

- NIC/Valid Passports of the Directors and Authorized person in Sri Lanka

Once your TIN number registration is approved, you’ll receive an email from the IRD with your TIN registration certificate and a PIN to log into IRD eservices. For urgent applications, you can first apply online and then visit the nearest IRD branch to expedite the TIN registration process.

Congratulations on taking the first big step to starting your own business in Sri Lanka! Now your business is officially registered.

How much money do I need to start a business in Sri Lanka?

Business registration fees in Sri Lanka differ based on whether you’re registering as an soleproprietorship, partnership, or company, as well as the size of your business. Below is a breakdown of the registration fees for different business structures.

Individual business registration Sri Lanka price

Sole proprietorship is the best business to start with minimal investment. In Sri Lanka, small business registration fees will vary based on your starting capital. If you’re starting a small business with an initial capital of 299,999 LKR or less, the fee is 1,500 LKR. For a medium-sized business with an initial capital between 300,000 and 499,999 LKR, the fee is 2,500 LKR. If you’re investing more, with an initial capital exceeding 500,000 LKR, the fee is 3,500 LKR.

Partnership business registration Sri Lanka fees

The costs for registering a partnership business in Sri Lanka are similar to individual business registration prices. If your initial capital is 299,999 LKR or less, the registration fee is 1,500 LKR. For partnerships with an initial capital between 300,000 and 499,999 LKR, the fee is 2,500 LKR. If your partnership is starting with an initial capital of over 500,000 LKR, the registration fee is 3,500 LKR.

Company registration fees in Sri Lanka

The Department of Registrar of Companies revised company registration charges in Sri Lanka in October 2022. Now the cost for registering a private limited company is 16, 613 LKR. This fee includes the cost of reserving your company name (2761 LKR) and the registration fees(13,852 LKR).

Please note that this is an estimated cost for a company with one director and one secretary. Actual incorporation costs can vary depending on the number of directors and secretaries.

For a complete breakdown of company registration fees, check out our guide on online company registration fees in Sri Lanka.

Offshore company registration fees

To set up an offshore company in Sri Lanka, you’ll need to pay a registration fee of 172,500 LKR (excluding name reservation), plus an additional 100,000 USD deposit in a local bank.

Overseas company registration fees

Registering an overseas company in Sri Lanka will cost you 69,000 LKR. This does not include the name reservation fee.

Can I start a business without registering it in Sri Lanka?

According to section 2 of the Business Names Ordinance, every individual or firm carrying on a business under a name that isn’t the full legal name(s) of the owner(s) must register their business. This means that if you’re running a business under your full name, there’s no need for formal registration. You can simply operate under your own name and just pay your taxes. For example, if Joe Yvonne owns a clothing store and her business name is ‘Vinu Yvonne’, she does not need to register it. But if she adds a descriptive word before or after her legal name and operates under a fictitious name such as ‘VinuY Clothing’ or ‘Clothing by Vinu Yvonne’, then she DOES need to get a BR.

If you plan to set up a company in Sri Lanka, reserving a company name and incorporating it with the Registrar of Companies is mandatory under the Companies Act.

Counselit Simplifies How to Register a Business in Sri Lanka

Ready to take the next step and start your business in Sri Lanka? Having the right expert by your side can make the business registration process much easier. At Counselit, we assist online startups & entrepreneurs, small businesses, mid-sized businesses, freelancers & creators, SaaS, and e-commerce businesses with online company registration, trademark registration, technology & commercial contracts, tax consulting, and registered Company Secretary services in Sri Lanka.

If you have any questions about how to register a business in Sri Lanka, how to register a company online, or online company registration fees in Sri Lanka, don’t hesitate to reach out to us. Call us at +94760011066, email us at contact@counselit.com, or book a call online. We’d be happy to connect.