If you’re a business owner about to hire your first employee, you’re probably wondering how to register for EPF as an employer in Sri Lanka. EPF registration is mandatory for every employer, even if you have just one employee, regardless of the type of business or nature of employment, except for social service organizations that train minor offenders or assist the deaf, blind, or destitute, charities with fewer than ten employees, and employers of household workers (Section 2 of the Employees’ Provident Fund Act No. 15 of 1958).

Below, I’ll explain, step by step, how to register for EPF as an employer and what documents you’ll need to apply for EPF registration in Sri Lanka.

Table of Contents

How to register for EPF as employer in Sri Lanka?

If you’re a new employer, follow these 8 steps to register your company for EPF.

Step 1 – Fill out Form D

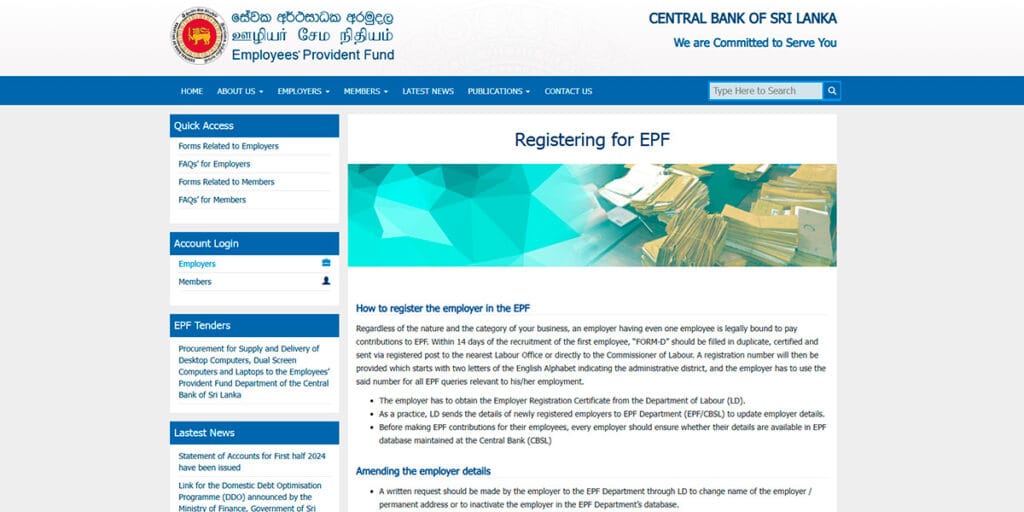

- Within 14 days of hiring your first employee, you should submit the EPF registration Form (Form D) and D annexure in duplicate to register for EPF as an employer (section 8 of the EPF Act)

- The form needs to be certified and sent by registered post to the nearest Labour Office or you can hand it over directly to the Commissioner of Labour.

Each time you hire a new employee, you’ll need to register them with the Labour Department within 14 days of their recruitment.

Step 2 – Receive Registration Number

- After submission, you’ll get an employer registration number. This number typically starts with two letters that represent your administrative district.

- You’ll need to use this number for all EPF-related matters.

Step 3 – Obtain Employer Registration Certificate

- Once you’re registered for EPF, you will also get an Employer Registration Certificate from the Department of Labour (LD).

Step 4 – Check EPF database

- After registering with LD, the Department sends your details to the EPF Department at the Central Bank of Sri Lanka (CBSL).

- Before making EPF contributions, make sure your details are forwarded and correctly updated in the EPF database.

Step 5: Complete ABH forms

As an employer, it’s your legal duty to register your employees for EPF and start paying EPF contributions from their first day of appointment, regardless of whether they are permanent, temporary, casual, or shift workers. You’ll need to provide each employee with an AH form (formerly known as the ABH form). Make sure the forms are filled out correctly with their NIC details, and then submit them to the Labour Department, either by hand or through registered post.

Step 6: Assign Member Numbers

Assign a unique member number to each employee, in order, to avoid any duplication. You can’t give a number that’s already assigned to another employee at present or in the past.

Step 7: Issue the “B” Card

After registration, the Labour Department will return a signed “B” Card for each employee. You’ll need to give a copy to the employee and hold onto the official records.

Make sure to notify the EPF Department when an employee resigns, retires, or otherwise leaves your business. Use Form E (filled by both you and your employee) and Form F (filled by you only). Once these forms are submitted, you’re no longer required to make EPF contributions for that employee.

If an employee loses their “B” Card, guide them through the process of getting a replacement.

Step 8: Register for EPF online service

As per the EPF (Amendment) Act No. 2 of 2012, if your business has 50 or more employees, you’re required to submit monthly EPF contribution details through the EPF e-return system.

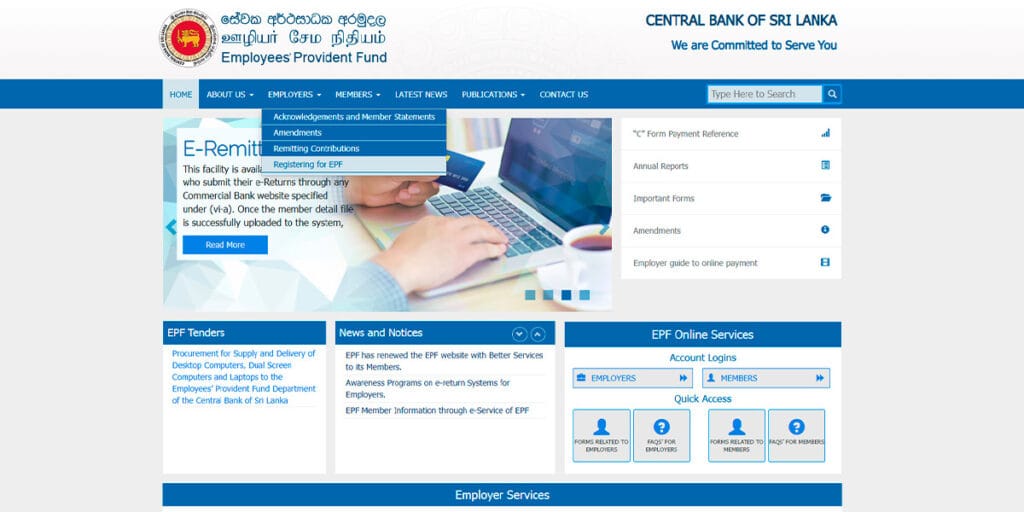

To register for EPF online services, visit the EPF Department’s official website https://epf.lk/, and follow the steps below.

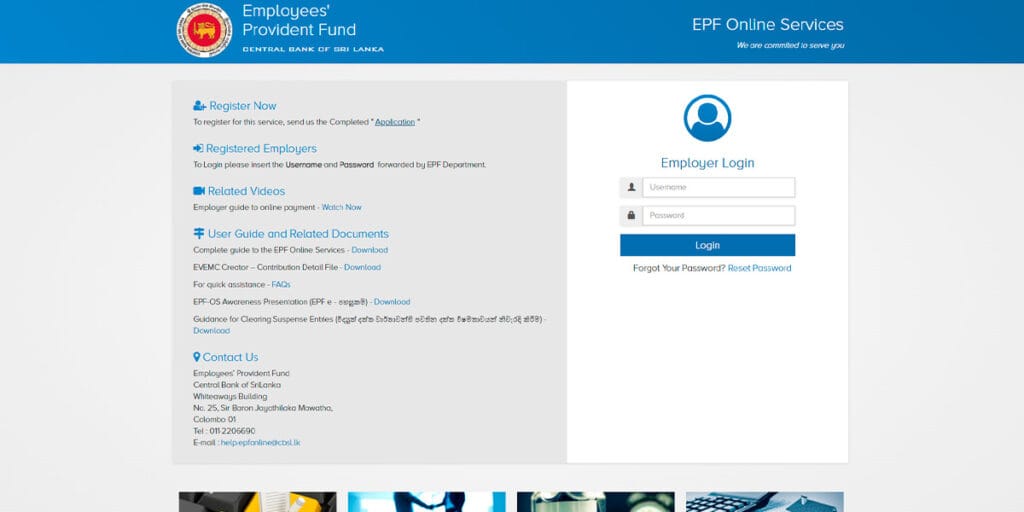

Next, click on ‘Register Now’ and select ‘Application’ to download the EPF Online Registration Form. You can also download the application form pdf below.

Fill out the application, scan it in color, and email it to help.epfonline@cbsl.lk.

Once your application for the creation of an employee provident fund account is approved, the EPF Department will send you a system-generated PIN document with your username and password to access your EPF online service account. You can collect these login credentials either by visiting the E-Collection Division of the EPF Department or by receiving them via registered post. With the employer login, you can create monthly EPF contribution files and make payments online.

Now that you know how to register for EPF as employer, let’s take a look at the documents required for EPF registration.

Documents required for employer EPF registration in Sri Lanka

1. Form D

You need to submit two original copies of the completed “Form D” for registration.

If you have 10 or fewer employees, also include two certified copies of the “Form D” annexure (with an official seal).

If you have more than 10 employees, provide a detailed list with each employee’s name, age, job type, salary, and start date.

The certifier (the person who signs “Form D”) must also certify and affix their seal.

If the certifier is not the owner or a partner, a power of attorney should be produced.

2. Explanation for Delayed Registration

If your business is registering for EPF more than two years after starting, you must explain the reason for the delay in writing.

3. Certification from the Board of Directors

If your company transfers employees from one department, branch, or entity (for example, through a merger, acquisition, or restructuring), a certification from your board of directors should confirm the transferred employees’ statutory rights will continue.

4. Duly attested Annexure D

If a director or partner’s name is listed in Annexure D (employee list), another director or partner must certify the forms, not those mentioned in Annexure D.

5. Business registration certificate and formation documents

Individual Business (Sole Proprietorship)

- Photocopy of the business registration certificate.

- Photocopy of the proprietor’s National Identity Card.

Partnership Business

- Photocopy of the business registration certificate.

- Photocopies of National Identity Cards for all partners.

Limited or Private Limited Company

- A true copy of the company incorporation certificate.

- Copy of eROC forms 01, 05, or 20, 40, certified by the Registrar of Companies and your Company Secretary.

Foreign Company

- A true copy of the business registration certificate or certificate of incorporation.

- Copies of forms 44, 45, and 46, certified by the Registrar of Companies and Company Secretary.

- If the signer of “Form D” is not listed in forms 45 or 46, include a copy of the power of attorney.

- A true copy of the National Identity Card or passport of the person holding the power of attorney.

When Employees Provident Fund new registration is required?

An employer must apply for EPF registration in the following situations.

Registering a new business

If you’ve just set up a new business, you must apply for EPF registration.

Re-registering Your Business

If you change the legal structure of your business, you must re-register for EPF.

Changing Your Business Address

If your business moves to a new location, you must notify EPF.

Changing Your Business Name

If your business name changes, you need to inform the EPF.

Changing Business Ownership

If the ownership of your business changes through the transfer of shares, a merger or acquisition, or when a partner leaves or passes away, you must submit an application to update the EPF records.

Learn how to register for EPF as employer today

Registering your business for EPF is essential to staying compliant with Sri Lanka’s labor laws. Whether you’re a founder, freelancer, or a newly established company planning to hire your first employee, understanding how to register for EPF as an employer is crucial to getting everything in order before starting operations.

Need help? Contact me today for expert assistance with your EPF registration in Sri Lanka. Feel free to call my law office at +94760011066 or email chamalee@counselit.com for a free 30-minute initial consultation.